Scholarship Granting Organization

Claiming Your Indiana Tax Credits

Common Questions

What is the SGO and what does it do?

The Scholarship Granting Organization (SGO) is an Indiana state-certified 501(c)(3) non-profit formed to award financial scholarships to families to attend a non-public school of their choice. Families must meet certain eligibility and income requirements to qualify for the award. Funding for scholarships come from private, charitable donations to the organization the donor designates, such as the Lafayette Catholic School System. Donations to fund SGO scholarships feature a 50% state tax credit for the donor.

What are the tax benefits to making a gift to an SGO?

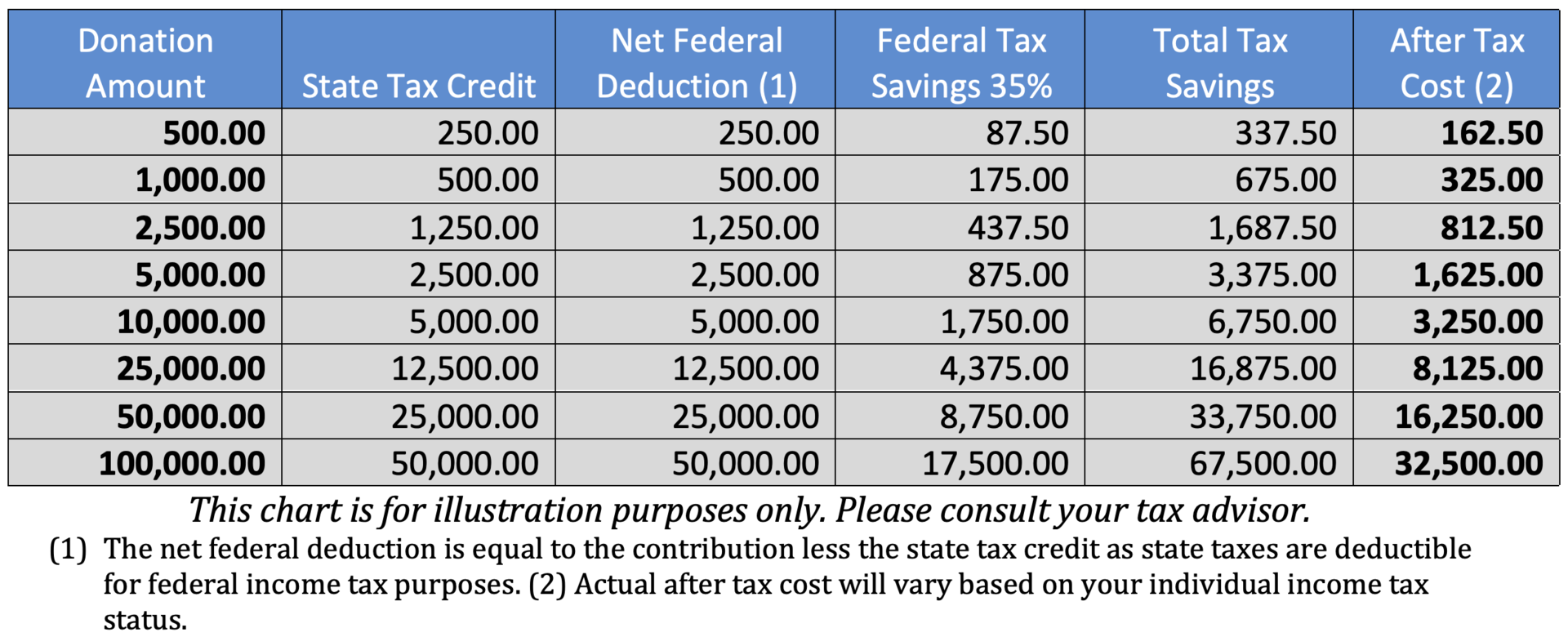

Individuals and businesses who contribute to an SGO qualify for a 50% Indiana state tax credit and a federal tax deduction. The following chart illustrates (at a 35% federal income tax bracket) the after-tax "cost" of the donation amount.

How do I make a gift to an SGO?

Donations can be made via cash, check, credit, or debit card to the Institute for Quality Education. Note:

All gifts in the mail must be accompanied with a completed donor form (see link above) and sent to the following address:

- Checks to be made payable to the Institute for Quality Education, NOT LCSS.

- Gifts can also be made online at http://www.i4qed.org/sgo/donors.

- Be sure to designate the Lafayette Catholic School System - Lafayette as the school for your SGO gift.

- SGOs provide each donor with a receipt containing a Tax Credit Certification Number (TCCN) for tax reporting purposes.

All gifts in the mail must be accompanied with a completed donor form (see link above) and sent to the following address:

Institute for Quality Education

101 West Ohio Street, Suite 700

Indianapolis, IN 46204

Can I make gifts of Stock and Securities?

Absolutely! In fact, you can avoid capital gains taxes by donating appreciated stock. Contact the LCSS Advancement Office and we will walk you through the process. (765) 474-7500 or [email protected].

How do I know that I received the Tax Credit?

After your gift is received and deposited, staff at IQE will submit the required information to the Indiana Department of Revenue ("DOR"). The DOR will then provide IQE with the credit certificate number for your donation, and they will send you the code and your official thank you communication by email for your tax records. The entire process from donation to credit communication should be less than two weeks. You may contact the LCSS Advancement Office at any time to check on your donation status. (765) 474-7500 or [email protected].